We all save money and then invest a part of our savings to meet our future requirements. We want maximum returns and do not want to make any bad investments. There are certain things which we should look into before making any investment.

1. Do not invest in things that you don’t understand:

We should invest only into things which we understand. Whether it is mutual fund or bond or stocks or crypto currency, it is important to understand them before making any investment decisions. It may be, that your friends or colleagues are making lots of money from stocks or crypto currencies or any other investments, but do not try to imitate them or follow them blindly. You need to have basic understanding of the things which you are investigating into. You need to understand their business model, their background, financials and future prospects. You should always try to learn new things that interest you but you should never invest in things that are out of realm of your understanding.

2. Understand the risks and the returns:

Risk and returns are different sides of the same coin. The returns will be high if the risk is high. An investment that promises you 15 percent rate of return would obviously have more risk as compared to an investment that gives you 8 percent rate of return. Suppose you invested in a stock that gave you 50 percent return in a year. It would be extremely volatile. It can come done crashing even in a single day. The safe investment as we all know offers lowest returns for your money. Most of the people flock to these safe investments because no one wants to lose their hard earned money. However for a risk taker hungry for huge returns, these safe investments are not as appealing. They prefer riskier investments with potentially higher returns. Now, it is up to you to determine your risk appetite and invest accordingly.

3. Diversification is important:

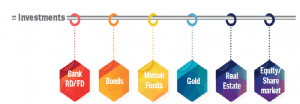

One of the best ways to secure your money when and to guarantee a good return is to diversify your investments. You should invest in different asset classes such as fixed deposits, recurring deposits, bonds, mutual funds, commodities, stocks in different sectors, real estate etc. If you hate losing money then diversification is your safe bet. This safeguards your investments as well as helps in growing your money as well. By diversifying your portfolio you are ensuring your investments against constant market volatility that can easily wipe out your money. The returns of the different assets may not fall at the same time; a fall in the price of one asset may be offset by a rise in the price of another asset thereby protecting one’s investments from losses.

4. Investments costs matter:

All costs matter. Even 1 percent fees could often go unnoticed. Many people don’t pay attention to the small fees they are charged. Although a small 1 percent fees may not mean much, if you do the calculations you will be completely surprised as to how much you could potentially lose. Suppose you are investing in two different mutual fund companies. One is charging your 1.5 percent annual management fees and the other charges 0.5 percent. It is not a big difference. Initially it may look so but over time that small fees could result in you losing thousands of rupees in the years to come. It is perceived that the fund companies that charge more have more money for research and they do a better job. However, the investors who minimize the overall costs do the better overall.

5. Have a margin of safety:

Price and value for your money will always matter when it comes to investing. One of the best principles is to have a margin of safety. It means purchasing assets less than their intrinsic value. Sometimes, the assets will be priced less than their intrinsic value especially during a recession period. Acquiring an asset at a lower price or below its market price is always a good deal for an investor because the return on investment is almost guaranteed. If for some reason he has to sell the asset quickly then the margin of safety will protect the investor. We all know that the circumstances can easily change in financial markets. Financial markets are sensitive to multiple factors. Just see what happened because of Corona virus. Markets plummeted all over the world within short period.

6. Asset allocation:

Asset allocation is key to good returns. The way an investor divides his investment amongst different assets is key to ensuring high returns on their investments. This is where many investors fail because they give very little thought into their asset allocation strategies. By investing solely in overvalued assets, you are bound to experience low long term returns. The key is to evaluate all categories. One should underweight the expensive categories and overweight those that are bargain priced.

7. Have a long term mindset:

Surely that you can make few bucks if you speculate in the financial markets. In the process people lose lot money chasing the next big wave in the short term. The correct way is to purchase assets at lower prices and waiting for their prices to appreciate which may take long time. Warren Buffet has said “Long term investing is one of the most important investing principles, as short term trading will only lead to lower returns.” Don’t let fear or greed take over your investment decisions process and let time its thing.

8. Power of compounding:

If you are looking for exponential growth then you should better understand the power of compounding and how it works. One of the most exciting aspects of the compounding is the multiplying effect it has on your money over time. Compounding is also called “interest on interest”. The benefit is that the interest earned is added to the principal and reinvested. Instead of constantly withdrawing dividends keep the money there and watch how much more you will be able to make.

9. Risk Management:

Nothing worthwhile comes in life without its fair share of risk and investing is no exception. To minimize risks investors apply risk management strategies. Volatility in one’s portfolio is risky and wipe out our returns in a flash. It’s a serious problem. By managing risks you will make sure that you do not lose money. You can control your portfolio volatility but you cannot control financial markets volatility. Use risk management strategies wisely as per your risk appetite.

10. Control your destiny:

You should be in charge of your money because no one will care about your finances as you do. Conflicts of interest, frauds and absurd fees make self investing a very attractive option. Today technology and internet has helped in bringing down the fees and all other transactions costs. It also provides all the needed information to make the right investment choices. You can be a self directed investor with minimal effort. Instead of focusing to get a fund manager or a finance expert see what you can do by yourself. You will be surprised how much you can save in fees and transaction costs. You should continuously learn and research: There is a lot of information available on the internet. Use this to learn new trends. Find out new opportunities and channels of investing your money. Most of the resources are free and some are available for small fees. Continuously watch business news. Understand what is happening. By adopting these strategies you will soon become a good investor and be able to maximize your returns.

Navin Kumar Singh

Chie Manager (Faculty),

State Bank Institute of Learning & Development, Bhavnagar.