As the saying goes “A bird in hand is worth two in bush”, anything we receive today is better and more valuable than the something uncertain in terms of amount and time zone. With compound effect, even a penny becomes huge like the Mount Everest. This is the concept which makes Banks’ liability products like Recurring Deposit and Systematic Investment Plan attractive for an investor. The same principal applies to Negotiated settlement or compromise settlement. It is a very important tool for reducing Non Performing Asset in the Bank’s portfolio.

Any loan account added to the Bank’s portfolio is with the intention to add profit to the organization. It earns interest for the bank until it is standard. Once it turns to the Non Performing Asset, it becomes drain on the Bank’s profitability. More the NPA in a bank more is the stress on the balance sheet of the bank. It may lead to a vicious circle of the non productivity which may even lead to collapse of the bank. YES Bank’s collapse is a recent example of such collapse of one the promising Private Bank due to mounting of NPA. So, it’s one of the primary concerns of the bank to keep the show running in profitable manner. Every bank strives hard to keep the NPA at bare minimum level. Various modes of NPA recovery are there including soft recovery measures and hard measures. However, when the picture becomes blur and the chances of recovery looks bleak; every bank resort to the process of negotiated settlement for recovery.

As per instruction of Reserve Bank of India, each bank should have a loan recovery policy to cover negotiated settlements of Non Performing Assets; all Public Sector Bank’s have come up with One Time Settlement Schemes. The schemes are in pursuance of Board approved policies for various sectors like Agriculture, MSME and Personal Segment

So, the question is what is Negotiated Settlement? How it can be beneficial to the two parties involved for settlement, with radically opposite interest? Before discussing these questions, we need to understand negotiation. As the word suggests, negotiation is a basic means of getting what we want from others. It is a mutual agreement between parties with different needs and goals to arrive at a common understanding. Hence, negotiation also plays a vital role in resolution of stressed Assets through Compromise Settlement. Negotiated Settlement is also termed as Compromise Settlement.

Compromise settlement is a negotiated settlement where a borrower offers to pay, and the Bank agrees to accept in full and final settlement of its dues an amount less than the total amount due to the Bank under the relative loan contract. It’s a highly effective non-legal resolution by the Bank in appropriate cases. There are certain basic principles and guidelines to be kept in view by the branches and their controllers, while processing compromise proposals:

- Maximum recovery with minimum sacrifice.

- The realizable value of security charged or uncharged to the Bank.

- Net Present Value (NPV) of Securities and Compromise Amount:

This is the most important factor in arriving at the compromise amount. The NPV of settlement amount should be more than the Net Present Value (NPV) of the realizable value of securities. In case of lower value, the same has to be justified with valid reasons.

- Normally an initial deposit of at least 5% of the offer amount may be taken from the borrower under no lien account as an evidence of the borrower’s intention to pursue the compromise settlement with the Bank along with the compromise offer letter.

Default Clause enables the Bank to enforce all the rights prior to the compromise settlement and can also proceed with the execution of the decree/recovery certificate in case of non fulfillment of the terms and conditions of the negotiations.

Some of the important factors for analysis of the compromise proposal are a) Value of securities charged to the Bank and their salability; b) Other assets of the borrowers / guarantors; c) Status of legal action; d) Ability of the Bank to enforce the security and e) Time involved in realizing the security.

Negotiated settlement will always include some sacrifices or concessions. However, the extent of concessions will depend on a number of factors.

What is in it for the Bank?

NPA in the Bank’s portfolio is two way losses to the Bank. One is no recognition of interest in NPA account and other is the loan loss provision from the profit earned. So, these are the basic benefits to the bank:

- Time Value of the money is the first and primary benefit in negotiated settlement. Money which is recovered today can be reinvested in the profitable business.

- Some assets like stocks and machinery gets depreciated very fast. So, by the time bank gets possession through the legal route, the realizable value become minimal. So, it’s better not to spend good money in suit proceedings after bad money, specifically in such cases.

- Our judiciary system is over burdened with the cases and promotes settlement through Lok Adalat to curtail the time of settlement.

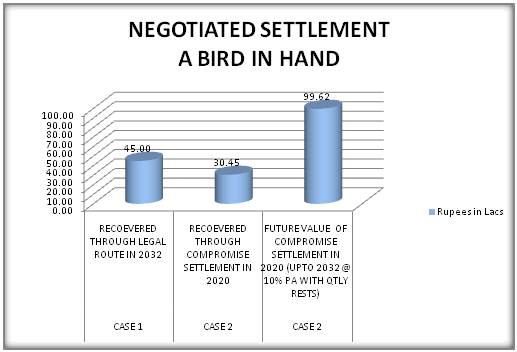

Impact of Time value of the money and Opportunity Cost can be seen from even a simple illustration given below. If take inflation rate in the consideration, the difference will be even much more than what is illustrated here.

|

CASE 1 (NPA DATE: 31.03.2017): DUES RECOVERED TRHOUGH LEGAL ROUTE AFTER 15 YEAR ON 31.02.2032 |

||

|

(In Rs.) |

||

|

1 |

OUSTANDING AS ON DATE OF NPA AS ON 31.03.2020 |

3000000 |

|

2 |

NOTIONAL INTT AS ON 31.03.2027 |

9531745 |

|

3 |

OUSTANDING LEGAL AND OTHER CHARGES AS ON 31.03.2020 |

225000 |

|

4 |

TOTAL OUTSTANDING AS ON DATE AS ON 31.03.2020 |

12756745 |

|

5 |

REALIZABLE VALUE OF STOCKS & MACHINERY AS ON 31.03.2020 |

1000000 |

|

6 |

UNSECURED OUTSTANDING AMMOUNT AS ON 31.03.2020 |

11756745 |

|

7 |

AMOUNT RECOVERED FROM THE BORROWER/GUARANTOR |

4500000 |

|

8 |

AMOUNT SACRIFICED |

8256745 |

|

CASE 2 (NPA DATE: 31.03.2017): COMPROMISE SETTLEMENT DONE AFTER THREE YEARS ON 31.03.2020 |

||

|

(In Rs.) |

||

|

1 |

OUSTANDING AS ON DATE OF NPA AS ON 31.03.2020 |

3000000 |

|

2 |

NOTIONAL INTT AS ON 31.03.2020 |

993000 |

|

3 |

OUSTANDING LEGAL AND OTHER CHARGES AS ON 31.03.2020 |

45000 |

|

4 |

TOTAL OUTSTANDING AS ON DATE AS ON 31.03.2020 |

4038000 |

|

5 |

REALIZABLE VALUE OF STOCKS & MACHINERY AS ON 31.03.2020 |

2000000 |

|

6 |

UNSECURED OUTSTANDING AMMOUNT AS ON 31.03.2020 |

2038000 |

|

7 |

WAIVER OF NOTIONAL INTERSET OFFERED |

993000 |

|

8 |

COMPROMISE AMOUNT (MUST BE MORE THAN SR NO.5) |

3045000 |

|

9 |

AMOUNT SACRIFICED |

993000 |

|

10 |

OPPORTUNITY COST OF THE FUND FOR NEXT 7 YEARS @ MODEST 10% pa with monthly rests |

9961686 |

What is in it for the Borrower?

- Waiver, either in full or part of penal interest, if charged, Reduction in the rate of interest, from the date the account became NPA, Partial or complete waiver of interest charged / accrued after the unit became NPA, Waiver of a part of the principal dues, Partial or complete waiver of legal and other expenses incurred by the Bank. So, the settlement amount will be lower than the contracted one.

- Release of the assets charged to the Bank.

- Save time, energy and money which are otherwise wasted in legal route.

- Keeps banking avenues open.

- Saves social status avoiding label of a borrower with suit filed by the bank.

Negotiated settlement is a win- win situation for the Bank as well as the Borrower and in a true sense, it’s “A Bird in Hand” for the Bank.

Deepak Parmar

AGM & Director, SBILD Bhavnagar.

(Author of the Book “Heart Beat is Chargeable Now”)