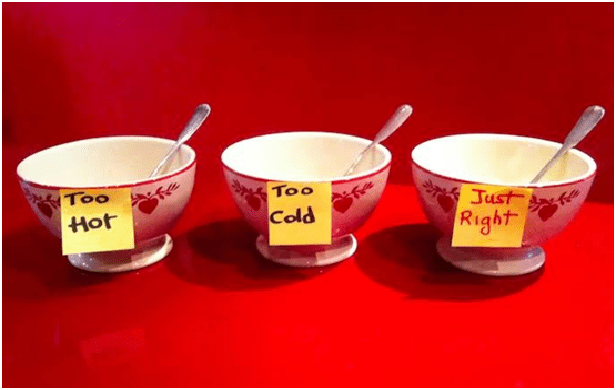

Goldilocks and the three bears is a popular English fairy tale. In the story Goldilocks is offered three cup of porridges. The one which is accepted is one which is neither hot, neither cold but just the perfect temperature. It is widely believed that Indian economy is all set to enter Goldilocks Phase. As per a recent research by Morgan Stanley Asian economies such as China, Singapore, Indonesia and India is all set to abandon the ill effects of Corona pandemic and all set to enter the Goldilocks Phase.

Coined by David Shulman of Salomon Brothers in 1992, the phase indicates an era of equilibrium. It is a phase wherein the economy is neither too hot to fuel inflation and neither too cold to trigger recession. Some of the identifiable features of this phase are low unemployment rate, low inflation, low market interest rates, steady GDP figures and economic stability. Let’s discuss some of its features:

- Low Inflation: – Inflation is a measure of Nation’s purchasing It is measured by consumer price index and producer price index prevalent in that country. Low inflation is helpful to Nation’s in stress as it keeps essential prices low and doesn’t lead to social uprising.

- Low unemployment rate: – Low unemployment rate per se doesn’t mean number of unemployed people in a It means number of people who are willing and capable of doing work but are unable to do so due to lack of employment opportunities in a country.

- Low market interest rates: – Market interest rates are simply the rates charged by a financial institution when they lend money to the borrower. This is in turn is also dependant on the cost of raising funds by that financial institution from other Banks or the central Bank of the

- Steady GDP figures: – Gross domestic product, popularly known from its abbreviated version of GDP is the value of all services and finished goods produced in a country. Its growth is an indicator of country’s economic health. In Goldilocks economy it varies from 2 to 3%.

Whether is it good for an economy to be in Goldilocks phase is a question much debated by the experts. For Indian economy that has first time entered into technical recession (a state where an economy sees its GDP contract for two consecutive quarters) anything which brings some cheers to the economy is not a bad thing. A slow and steady start is always better than no start. Anyhow, the economies that have contracted so much during corona pandemic cannot be expected to start showing signs of tiger economies all at once. With improvement in factory output, increased demand, improvement in job market and easy access to credit, GDP is bound to make a recovery. It has also been predicted that economy would take a V shaped or U shaped return to pre Covid levels.

The role and impact of Goldilocks phase for financial sector more particularly banking sector is enormous. Whatever fiscal and monetary measures are being taken by government, Banks and various financial institutions has the role to percolate it down to the end users. Few monetary policy measures like reduction in interest rates are bound to spur demand as it incentivizes customers to borrow at cheap rates but customers only borrow when they can repay it or they if require funds meet demands of the market. Therefore only focus on monetary policies might not work. To create demand government needs to spend. The spending could be big infrastructure projects like rail, road, bridges etc. Inauguration of biggest renewable park in Mandvi Gujarat is actually music to the job starved economy. It is expected to create over 1 lakh jobs and an estimated investment of over Rs 1.5 lakh crore.

Long tax breaks to entrepreneurs, ease of filing statutory returns, a non nonsense approach towards completion of Govt. projects within stipulated time, ease of doing business are only some of the measures which can help us sustain in the Goldilocks phase. Typically Goldilocks economy is accompanied by a steady GDP growth of 2 to 3 %. However, there is always a chance for economy to fall back in recession if the monetary and fiscal measures are not continued or spending is curtailed.

For Banks it is an opportunity to consolidate and look inward. It would be an ideal opportunity for Banks to grow in organic and inorganic way. Organic way has always been most preferred way to grow especially for Public sector Banks wherein they utilize their own resources to grow their advances and deposit books. However, now every Bank is willing to leave aside old Banking practices and look for new ways of doing Banking. One of the best ways for any organization to grow inorganically is merger and acquisition. However with increased difference in assimilation of system, corporate and work culture, there are only few success stories in M&A field.

Hence, another more prudent and in fad way is to register an inorganic growth via partnerships, joint ventures, agencies etc based on shared and mutual beneficial interests. Many Banks have already joined hands with WhatsApp to provide payment services. Banks are also mulling tie up with various local and national NBFCs and MFIs to lend to unbanked sector and SME enterprises. Corona pandemic has forced every organization to look for synergies rather than competition.

The banking sector in Goldilocks economies will be more prudent while lending, would focus more on mutual cooperation, and would have to improve lending to retail segment which is badly bruised due to job losses and lethargy in demand. They also have to reduce the cost of lending and operations which can be easily done via focus to digital payments and digital lending platforms.

Conclusion:

If taken on face value Goldilocks phase of economy is a mixed bag. The economy neither contracts nor expands at an exponential rate, However it is a feature of maximum developing economies which has gone under contraction in this current pandemic. This phase though is ideal for investing, as an investor can be part of the companies which are growing and have solid financials. This is also a good time for Banks as they would have better view on their asset quality and can fix their books. They also have an opportunity to lend to companies having real financial strength and can play their role in Nation building. An economy which is in equilibrium is a good omen, as it would act as foundation for better economic growth in coming years. Slow and steady is the mantra for coming years. And everyone knows that “Slow and steady wins the race”.

Amit Kumar

Chief Manager (Faculty),

State Bank Institute of Learning & Development, Bhavnagar.