Money, a resource we all require, and yet, one that often eludes our grasp. In today’s world, understanding the art of money management is the key to achieving financial security, independence, and the ability to fulfill your dreams. Whether you’re just beginning your financial journey or seeking to refine your approach, this article will provide you with valuable insights on effective money management.

1. Define Clear Financial Objectives

Effective money management starts with setting clear financial goals. Without a destination in mind, you may find yourself navigating without a purpose. Ask yourself what you want to accomplish financially, both in the short term and the long term. Be it purchasing a home, funding your child’s education, or retiring comfortably, your goals will act as a compass guiding your financial decisions.

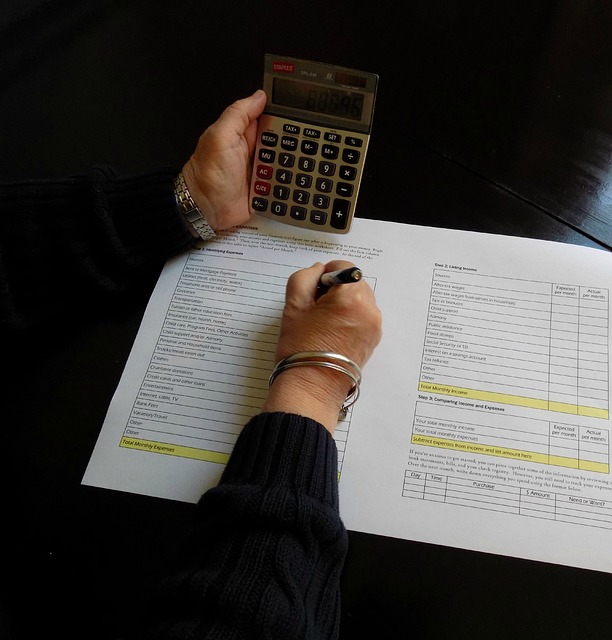

2. Develop a Budget

A budget acts as your financial roadmap. It helps you comprehend where your income originates and where it’s expended. Begin by documenting your sources of income and all your expenses. This will provide you with a lucid understanding of your cash flow. The aim is to spend less than you earn, allowing room for saving and investing.

3. Establish an Emergency Fund

Life is inherently unpredictable, and emergencies can arise at any time. An emergency fund serves as your safety net, offering financial security when unforeseen expenses occur. Strive to save a minimum of three to six months’ worth of living expenses in a separate, easily accessible account.

4. Address Debt Strategically

If you have debt, especially high-interest debt, it’s crucial to address it systematically. Develop a plan to repay your debts, beginning with those with the highest interest rates. This approach can free up funds for saving and investing.

5. Invest Prudently

Investing is one of the most effective means of increasing your wealth over time. Consider diversifying your investments across various asset classes, including stocks, bonds, real estate, and mutual funds. If you are uncertain about investing, consulting a financial advisor to construct a well-balanced portfolio that aligns with your risk tolerance and financial objectives is advisable.

6. Save and Automate

Automating your savings is a potent money management strategy. Create automatic transfers to your savings or investment accounts immediately upon receiving your income. This reduces the temptation to spend the funds, ensuring consistent growth in your savings.

7. Pursue Continuous Learning

Financial literacy is a valuable asset. Expanding your knowledge about personal finance equips you to make informed decisions. Books, podcasts, seminars, and online courses are excellent resources for enhancing your financial understanding.

8. Review and Adapt Your Financial Plan

Your financial situation will evolve over time, and your money management strategy should evolve with it. Regularly assess your budget, investment portfolio, and financial goals. Modify your plan to align with your current circumstances and aspirations.

9. Guard Against Lifestyle Inflation

As your income increases, it’s easy to fall into the trap of lifestyle inflation, where you spend more as you earn more. While enjoying your earnings is essential, it’s equally important to resist the urge to overspend and allocate the surplus to savings or investments.

10. Seek Professional Guidance

When uncertain, don’t hesitate to seek professional financial advice. Certified financial planners can provide personalized guidance and assist you in making sound financial decisions.

Effective money management is not about amassing wealth overnight but about steadily building it while securing your financial future. By setting clear objectives, creating a budget, saving and investing judiciously, and continuously educating yourself, you can master the art of managing your money and pave the way to financial security and independence. Remember, it’s never too late to begin, and each small step you take today brings you closer to a brighter financial future.

-Admin, Wealthio.