There was a time when people used to seek permanent jobs. Of late a new workforce culture has evolved namely gig economy where both the job seeker and employer mutually agree for a short term contract. The gig economy comprises of part-time workers and freelancers constituting a labour market where no labour is permanent. This is migration from a full time 10 to 5 job to a task-driven, on-demand and result oriented work culture.

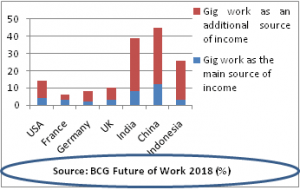

Some popular names in industry that are engaging gig workers are Swiggy, Zomato, Ola, Uber, etc. If the entire economy is viewed with respect to the emerging potential of gig workers many industries would come into picture but banking is one such sector where it is not as much visible. Extract from the report of BCG on Future of work 2018 suggests that gig economy is quite flourishing in both the developed and developing economies as an additional source of income as such the idea of harnessing this potential in banking sector is receiving wide focus from the players. In the Covid-19 scenario when many corporate offices are sheltering to WFH (work from home) and WFA (work from anywhere) to keep their business ticking on, the idea of introducing gig economy in Banking sector is very relevant.

Conducive factors for gig economy:

Digitization, increased mobile density and scope of portable works have facilitated execution of various jobs through end to end automation minimising personal contact which has lowered dependence on traditional workforce for many jobs of routine nature. E-tailers like Amazon, Flipkart etc., have manifested use of gig workers for delivery services, logistics handling and packaging while the processes of selecting, ordering and payment are handled electronically in a self driven mode on the online marketplace.

Gig workers also provide a cheap labour market in comparison to traditional one. Minimum wages payable to a freelancer is way less than the average wage payable to a permanent employee with same set of skills. Instead of full salary their remunerations are mostly linked to completion of a specific task as such cost cutting also attributes to searching for an alternative labour market in a competitive scenario.

In traditional hiring, the companies face lot of difficulties and incur huge expenses in selecting, training and continuously upgrading the skill and adaptability of workers. With the option of gig worker in the system, the employer may choose the most suitable skilled worker then and there without too much investment.

Most of the gig workers belong to younger generation also called millennial. Factors like freedom of work without much movement add attraction due to changing lifestyles, work-life balance and aspirations for generating additional income altogether. The Government of India has also taken initiative to push gig workers through the Digital India Program (DIP).

Stepping forward:

So far Indian start-ups have been employing most freelancers basically due to cost cutting measures. Small finance banks and payment banks are taking lead in employing gig workers to reach out to the bottom of pyramid and increasing its customer base. According to a report of Bloomberg India has more than ten crores microfinance accounts which are serviced in cash every week by gig-economy workers who, inter alia, sell vegetables on street corners or embroider saris which are sold in malls.

In a recent development, one of the premiere private banks of India, Axis Bank, has pioneered in launching a project namely Gig-a-opportunities on pilot basis to leverage skilled talent across geographical boundaries by going beyond traditional definition of when, where and how a job can be done. Axis Bank, with this initiative, expects to fulfil around 15% of incremental hiring requirement in the next three years in the alternative work models like gig-contracts or short term contracts in the areas like, credit monitoring, early warning system, credit policy specialists, banking sector advocacy & policy specialists, internal auditors, learning & development trainer and lending in SME & retail. The successful implementation of this innovative idea would certainly be a precursor for other banks.

Challenges:

Security Risks: Banking transactions involve lots of customer data available to workers which means security is a top concern. Banks fear the possibility of leaks either malicious or unintentional which may cost heavily to the organization. Introducing outside talent to the ocean of confidential customer data is often looked at by top management as a precarity waiting to happen – even if the workers are trustworthy.

Regulatory compliance: Providing timely and accurate service to a customer becomes challenging when it is subject to a host of regulatory compliances. Any instance of non-compliance is adversely viewed by regulators and it also poses inherent risk. Selection of services and products proposed to be channelized through gig workers would require model testing to make it system compliant before it could be fully relied upon.

Learning & development: Although skill based human capital can be easily winnowed from market for deployment. However, in absence of a dedicated HR policy for gig workers real time knowledge upgrading on a regular basis directed towards new initiatives, changes in various policies, products and laws may be difficult as such strong checks and balances would be required.

Conclusion:

While the gig economy concept is quite popular and flourishing in big economies like USA and China it has also made its footprint in India very fast. It is true that digitization has nurtured the ecosystem in such a way that it has made the talent pool of the country location-agnostic and boundary less. At a time when door step banking, contact less lending platforms and digital banking services are gaining popularity among the new generation, use of gig workers as a tool to fuel the momentum would be strategically important for the banks only its sustainability aspect would require to be examined from both the customer and regulators perspective.

Vineet Kumar Das,

Chief Manager(Faculty),

SBILD, Deoghar.