Blockchain and Bitcoin are twins is a fact that is known to a very few, later being the buzzword of recent past and former is the technology behind. Satoshi Nakamoto the pseudonym behind the origin of Blockchain Technology, remains incognito as to whether he is a particular person or a group of developers.

The notion behind the Blockchain technology is not an out of the box thinking but derived from the existing style of handling the physical currency/documents. In other words, it is simply a migration of concept from physical to digital platform in a safest possible and tinker proof environment. Timestamping of documents is the thought process and inspiration which is conceptualized in replicating the same in the transactions. The major task at hand was to solve two pronged issues i.e. the double spending problem and elimination of central trusted third party.

Double spending problem is mainly associated with digital mode of currency as there is an involvement of time lag in confirmation of a committed transaction. This time lag factor invites the attention of manipulators/hackers to use the floating information for replicating or may be reversing the very transaction as it has never existed. Towards the serious note, the digital information is prone to manipulation/defraud by those who possesses significantly good amount of computing knowledge.

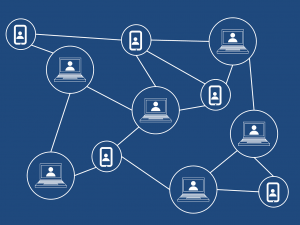

Central third parties are traditionally a part of every transaction. On account of heavy database, they possess, their database is prone to hackers and often encounters technical glitches in rendering of service to their customers. Blockchain technology comes to the rescue as it eliminates the third-party involvement and provides secured and glitch free service to the users. The database on the blockchain is not available at a single place but is shared with all the systems present on the distributed network.

Concept explained: Blockchain is a chain of data blocks containing information connected in a predefined limited series which is shared among all the stakeholders in form of a immutable, decentralized and distributed ledger over the shared network. Various components need to be understood first to have a better insight about the functioning of the blockchain technology.

Data Block: It is a set of major parameters of the information necessary to carry out the transaction. Sender’s name, recipient’s name, amount, purpose etc. are major parameters in a simple transaction to be used as the information for the data block. The first data block in the series is termed as genesis block.

Hash: It is the process of converting the contained information of the data block into an encrypted output. This process uses a complex computing algorithm in creating of hash to the respective data block. This is first order of defense in the security level of the blockchain technology.

Public Key: Hashed form of data block information is known as public key and needs to be sent to the receiver by the sender for completing the transaction in a secured way.

Private Key: This is embedded in the algorithm in such a way that the algorithm can be accessed but not the key. This is the secret key to encrypt or decrypt the hashed code.

Hash of previous Block: This is a very unique feature which comes second in the security layer present and forms a part of data block used in protecting it from the manipulators. Whenever a data block is added in the chain or series, the new data block must contain hash of the previous block in way to secure the chain. Whenever, any manipulation in attempted in the chain of data block the entire data chain will gets rendered invalid, say a chain consisting of 134 data blocks, data block number 47 is manipulated then the entire serious after number 47 will get rendered invalid as they contain hash of the previous data block. Any change to made in the chain or series of the data must be carried by a way adding a new block consisting the parameters of the required change and should be approved by most of the stakeholders on the shared data network.

Miners: They are individuals who can be freelancers or may be companies who carry out the work of mining the new data block by using their computing knowledge. In turn, the miner who first mines the data to the chain will get rewarded. The data will not get added to the chain unless and until it is mined by the miners and shared among the stakeholders over the distributed network.

Proof of work: Pow comes third in the security layer and it is a step carried out by the miner to add a new data block to the existing chain after using complex computing algorithm technique. There is good amount of competition in mining of the data as the first to complete the mining of data block will be rewarded. After mining of the data block, it is the duty of the miner to share the data over the shared network, which after confirmation of stakeholders will get confirmation of adding it to the existing chain or series of the data block.

Consensus: This is the most critical aspect of the security layer and can be described in a way that unless and until a new data block to the chain gets approval from majority stakeholders will not get added to the blockchain. So, consensus is a must thing for a new piece of information/change to get incorporated.

A typical example of blockchain transaction can be explained like, the sender with the combination of public key, hash, signature along with embedded private/secret key for the receiver generates an encrypted code, which is received and decrypted with the use of private/secret key by the receiver. This way the transaction on blockchain platform gets completed.

Blockchain technology is kind of technology, which is not be confused with the shared, immutable, decentralized and distributed network. It can be implemented in different ways depending upon the type of business i.e. banking, pharmaceuticals, land revenue record, cryptocurrency, e-retail, supply chain, digital IDs, data sharing, digital voting and what not. Depending upon the structure of the business proposition different types of blockchain technology in form of public, private and hybrid models may be engaged.

Opportunities for Blockchain technology in Banking

Remittances: In a traditional way of sending remittance from one person to the other or even inter country needs an infrastructure like third party i.e. Banks, NPCI, PayPal, Western Union etc. The intermediaries may have set some rules in place like transfer limits and the charges they charge customer in form of transfer charges for effecting the remittance. This system is prone to double spending problem as well which is explained above. Introduction of Blockchain technology with hybrid model will obviate all the issues encountered above. Hybrid model is an arrangement wherein some users say Bank employees get full access to the database and others say customers get limited access. Every person in the chain knows about other person ‘s status or funds position, so that there are no chances of originating an invalid transaction in the system. This will eliminate the chances of defrauding customers by the hackers/manipulators as it takes considerable time for breaking into the system, the time one breaks into the system, the series or chain of data block undergoes a change. So, this way the whole process of effecting the remittance gets secured and chances of manipulation is next to impossible.

Advances: Banks are finding a tough challenge in automating the process of online lending platform to the customers due to number of third-party searches/verifications like CIBIL, RBI defaulters list, ECGC caution list, CERSAI and so on. All these are independent searches and verifications without an interlinking mechanism. Fraudsters find opportunities to defraud on these loopholes present in the system. Blockchain technology with a private model will come to rescue wherein all the access to the information of customers is available to all third parties involved in the process of lending by the Banks.

Blockchain technology has all the capabilities and capacity to transform all the spheres of banking like Asset & liability management, data backup management, treasury operations, managing e-retail merchant partners, life insurance, general insurance, mutual funds, factoring and the list goes on.

Rajesh Dahiya

Chief Manager,

State Bank Institute of Learning and Development , Panchkula