The word amalgamation has its genesis in metallurgy. When two metals are joined together to form a different precious metal, it is called amalgamation. In banking parlance, the Social media banking is also an amalgamation of Social media marketing and Digital banking. When these two meet, a synergized phenomenon is generated known as social media banking. In layman terms, it is selling & promoting Banking products by use of various social media outlets. Let’s discuss it in detail.

In popular culture, social media is often associated with websites such as Facebook, Twitter, Instagram, Snap chat etc. With over 1 billion monthly active users in cumulative, they are a force and a market which is wild dream of a marketer. It has been massively used for product promotion and advertising in foreign markets for years now, but its tentacles have now wildly spread to Asian countries as well. Asian countries more particularly Indian sub continent boasts of average median age of 27 years. Add this to increased prosperity, disposable income at helm, improved opportunities to earn and open markets. What you get is a heady concoction whose marketing needs and demands are too good to satisfy for any organization.

Banking sector with the advent of new cheap and better technologies is also at the forefront to tap this market. Social media banking, a combination of social media and banking is slowly gearing to monetize this market. It is not only used for selling products but also can be effectively used for cheap brand promotion & advertising, customer retention, sales/leads generation, launch of new products and what not. Before we delve more into the topic, let’s find out what is social media marketing.

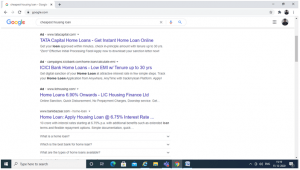

In layman terms a complete marketing cycle is to understand, create and fulfill the demands of the customer. Social media marketing is the promotion, advertising and sales done through various social media like facebook, twitter, Instagram etc. Though there are various means and ways to do so. Two medium that is Search engine optimization and Search engine marketing stands out being most used. Search engine optimization (SEO) and Search engine marketing (SEM). The advent of SEO and SEM is India was from year 2004 onwards. Interestingly we all have been using these medium of marketing unwittingly and unaware of its impact. Most of the top notch companies are even unaware of its impact and implication. But with the rise of millennial population, cheap data rates, mobile revolution and digital India no company in the world can look other way. To explain the phenomena let’s look at few screenshots.

A smart look at the screenshot and one can figure out, which companies are utilizing SEO and SEM. Some of the common keywords which are used in banking industry are online loans, cheap, cheapest, easy housing/personal/car loans etc and a permutation and combination of these words. These words are being bid for by advertisers. In case of SEO, the optimizers try to incorporate theses words in the source code of the websites and Webpage and correlate their websites to search engine algorithms.

The Ads which are coming in search results are example of SEM and the generic result is example of SEO. Around 35% of users search for products and services even before buying on Google. To put things in perspective, around 700 million people search for any product and services before making a sales decision. Google and other search engines are like malls wherein we do window shopping before making up our mind to shop. As per a research average customer enquires about or spends 30 minutes before placing a sales order. Let’s find out various means of online marketing.

- SEO: – It is the process of improving the quality and quantity of website traffic from search engines to a particular website. It is not a paid service. However SEO optimizers might charge some amount so that one’s website features on search of generic keywords.

- SEM: – It is a form of internet marketing that involves the promotion of websites by increasing their visibility in search engine results page. It is a form of paid advertising,

- Contextual Ads: – As the name suggests these ads appear on various websites, blogs, Vlogs as per the context or content of the webpage. For example, if the webpage discusses about travel goals, advertising pertaining to book tickets or hotels might feature for the viewer.

Some of the other types of online advertising are Pop ups/Pop under ads, Display ads, Banner ads, News feed, Trick banners and Floating & Expanding ads.

The revenue generation follows a model of pay per click and pay per view. The ad placer pays search engines only when somebody has clicked on the page and pay per view pays for every 1000 views.

The modus operandi for these types of promotions was first employed by foreign airlines &travel agencies in India. They were actually a curve ahead from its peers in knowing and utilizing its potential. It was further implemented by private insurers to sell insurance, Private Banking companies to generate demand for home loan, personal loan, car loan etc. Many PSBs are still a laggard in this sector or probably have not yet understood the full spending pattern and whole sales cycle of new, young digital India which buys and order everything online. They want everything on their footstep and on their finger tips. To see it in context, world’s top Banks are spending around 20 to 30% of their overall marketing budget on their online marketing initiative. Online advertising is expected to be 46% of all advertising spend by 2021 as per a survey.

Social media banking is not a step but a leap moving forward towards providing affordable, safe, fast and easy banking to the new generation. One can say, it is tailor made for this generation. With the boom of UPI, push towards digital banking, multitudes of payment companies and this corona pandemic, one can say that universe has conspired to make social media banking stay in our life. Whatsapp has already tied up with SBI and other Banking giants to provide payment facility. ICICI has already launched its interoperable app and other Banks are planning to do so. Everyone wants fast and fair banking and it is there to stay.

One of the biggest USP of social media banking is its social fabric, the consumer is able to transact with anyone he/she knows and trusts. There are no requirements of cheques personal visits to Branches and it is interoperable among all Banks. Crowd funding is already a fad, so is generation of funds for philanthropic purposes. Going forth, it could be used by the customer and Banks both to have access to each other. The boundaries of customers of different banks would be wiped away. Any bank would have access to customer of different bank. On the contrary, any customer would have access to products of different banks. They can pick and choose. According to a survey the average time spent on social media in a day by an adult was 2.5 hours in 2019 and expected to reach by 3 hours in 2020. Imagine tapping even few minutes of this precious time and providing them products they require or creating a demand for the same. Alternatively, customer would be delighted if it can reach out to various banking needs on the platforms he/she adores the most. The synergy could be unlimited.

Many startups such as policy Bazaar, Bank bazaar, Cred etc are banking on same and their business model is to provide multitude of opportunities under one roof. As per a survey the cost of on- boarding of a new customer is much higher than retaining an existing one. The social media platforms can be further leveraged through contextual and relevant product related advertisement, which is much cheaper than traditional TV and print advertising. This would not only greatly reduce marketing and advertising costs of the organizations but would also add to the bottom-line of the organizations.

Conclusion

A paradigm shift in marketing and advertising budgets and focus is required, if companies across the globe wish to tap this upcoming wave of social media banking wherein targets are millennial, Generation Z and Generation Alpha. The traditional methods of spending and generating revenues through print, mass media, brick and mortar outlets is passé. The attention of every organization should be now to latch on to social media bandwagon. SEO, SEM, contextual ads, Instagram, twitter ads are more relevant platform for banks to promote their products. Online and digital medium is going to drive next Banking revolution and every progressive organization is not leaving any stone unturned to tap it. The ease of banking also though comes with loopholes. In Indian market not everyone is tech savvy and with it comes to banking Brick and mortar financial outlets provides a sigh of relief for the those who are on the wrong side of the age. Moreover, digital frauds have increased manifold with the increase in UPI and digital transactions. Lack of any regulating bodies for such companies is also a major cause of heart burn. Though, the change is inevitable as history suggests, better technology, ease of operations, low cost and in alignment with today’s and future demands always trump over redundant technologies and old fashioned way of doing business. Social media Banking is here to stay and with all its Ifs and buts, it is a plunge worth taking. We can call it leap of faith.

Amit Kumar

Chief Manager (Faculty),

State Bank Institute of Learning & Development, Bhavnagar.